If you have a checking or savings account, you'll find the need for certain documents to withdraw, deposit or pay money. You can write a check to pay a named person a specific sum from your bank account, while you would use a deposit ticket or slip to put cash or checks into a bank account. Since these documents have different purposes, fields and steps, you'll want to know how to fill out and use both checks and deposit tickets.

Deposit Tickets vs. Checks: What’s the Difference?

Video of the Day

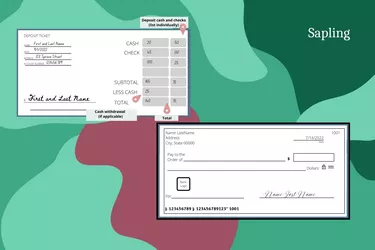

You can find deposit tickets both in your checkbook and at the counter at your local bank or credit union. You'll often need to complete one to document cash, coins and checks (including money orders, personal checks, payroll checks and government checks) and report whether you want the teller to provide cash back from the total deposit. Only the depositor would use these slips, and they serve as a receipt for the transaction.

Video of the Day

A check comes in various forms, all with the same intent to pay the amount of the check to someone from a bank account. For example, you could write a check for a bill payment or birthday gift to a loved one. The payee can then cash the check at their bank to receive the money as long as your account has sufficient funds. The Consumer Financial Protection Bureau explains that checks remain both a convenient and secure payment option.

How Do I Fill Out a Deposit Slip?

Follow these steps for filling out a bank deposit slip:

- Enter the date, your name and possibly your address on the left side of the slip.

- Write your bank account number in the "Account Number" field if it's not preprinted. The routing number should be preprinted.

- In the column on the right side, first list the total cash deposit amount.

- Proceed with listing your individual checks in the "Checks" section on the right column. Use the extra space on the back of the deposit slip if needed. Then total the checks if requested.

- Subtotal the cash and checks in the "Subtotal" field.

- Specify the amount of cash you want back in the "Less Cash" field. The First National Bank of Omaha says you'll need to sign your name in the signature area on the left for cash back too.

- Subtract the cash back from the subtotal to get the final net deposit amount.

How Do I Fill Out a Check?

Here's what to do when filling out a personal check:

- Specify the check date on the "Date" line.

- Write the name of the payee on the "Pay to the Order of" line.

- Write the numerical check amount in the box to the right.

- Provide the check amount in words on the "Dollars" line.

- Use the "For" line to specify the check's purpose or other important details.

- Provide your signature on the signature line.

Note that your personal check will have your name and address preprinted in the top left. In addition, you'll find the routing and account numbers for your savings or checking account along the bottom. A check number appears on the top right corner and possibly the bottom too, notes the Federal Deposit Insurance Corporation (FDIC).

Frequently Asked Questions

Here are answers to common questions about checks and deposit tickets.

Do I Always Need a Deposit Ticket When I Make a Deposit?

You'll usually need a deposit ticket if you're making a check or cash deposit with a teller at a bank branch. ATMs often require none since you'll have an option to specify a deposit when you insert your ATM or debit card, advises Capital One. You won't need a deposit slip to do a mobile check deposit.

When Do I Need to Include a Deposit Slip?

Unless you're depositing a check remotely or using an ATM, you can expect to include a deposit slip. However, bank policies can vary.

What Does “Less Cash” Mean on a Deposit Slip?

"Less cash" refers to any cash back you'd like when you make your cash or check deposit. This amount gets subtracted from the total amount to be deposited in your bank account at your financial institution.

Can a Deposit Slip Be Used as a Check?

Checks and deposit slips have different purposes, so you can't substitute one for the other. However, you can use a deposit slip to get cash back if needed.

What Is the Difference Between a Check and Direct Deposit?

A paper check is a negotiable instrument telling the bank to pay the named person a specific amount of money. The payee needs to cash this check to get the funds.

A direct deposit is an electronic transfer of money to a bank account using your routing and account numbers. It is considered more convenient and faster than a check, notes National Automatic Clearing House Association.