Some say we live in a cashless society, and to a large extent, we do. You may regularly use your debit card or credit card to purchase goods and services, or you might pay your bills online or send money to your kids via Venmo. Check writing is becoming a lost art.

But the ability to write checks from your checking account can still be useful. There are some situations in which you simply have to write a paper check, maybe to pay a contractor who doesn't take credit or debit card payments. This step-by-step guide with helpful FAQs will guide you whether you're writing the check for $1 or $1,000.

Video of the Day

Video of the Day

Make Sure the Money Is Available

Remember the golden rule of checking accounts before you write that check: You must have enough money in your bank account to cover the check or you'll create an overdraft. The bank or financial institution will "bounce" the check and it will most likely hit you with a hefty fee, usually in the neighborhood of $30 or $35. The bank might even close your account if you bounce checks too often.

And that's not the end of it. Businesses can be charged a $25 to $50 bank fee known as a "returned deposited item" fee when they attempt to deposit a check that bounces, according to HelpWithMyBank.gov. Many merchants will pass this fee onto you, and some may charge even more on top of that.

Fill in the Date and Payee's Name

Assuming that your account balance is sufficient to cover the amount of the check, start by choosing a pen with permanent ink, preferably black or blue. Fill out the check from the top down so the ink doesn't smudge when your hand rests on the paper.

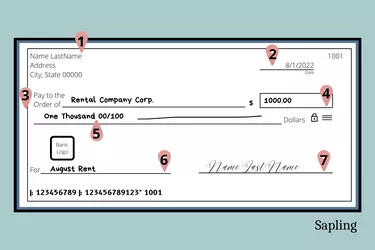

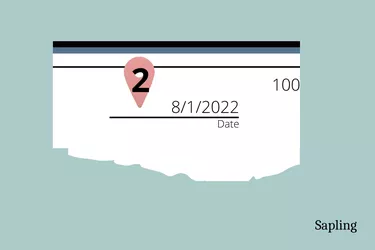

Write the current date in the date line area at the upper right corner of the check (designated as line 2 in the image). The space should appear right under or near the check number. It's not illegal to write a postdated check, one where you enter a future date, at least under federal law.

You'll want to check your state's rules before you do so, however, because state laws can differ. And keep in mind that banks can usually accept, cash and/or deposit a check before its noted date arrives so postdating it up may be for naught.

Write the payee's name next: the name of the person or company to whom you're making the check payable. This is entered on the line after the words "Pay to the Order of" (line 3). Be sure to use the individual's or company's legal, full name. You may know your best friend as "Joey Boo," but he's probably not going to be able to cash or deposit the check you write him in that name if his legal, given name is "Joseph Bloom."

Fill in the Check Amount

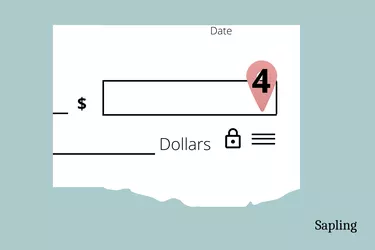

Write the numeric form of the dollar amount of the check in the dollar box (space 4 on the image): "1,000.00." The dollar sign is already printed there so you don't have to enter that.

It doesn't really matter whether you include the comma as long as the amount is otherwise clear, but you most definitely want to include the decimal point to delineate between dollars and cents. Otherwise, you could be writing a $1,000 check for $100,000. It's a good idea to fill the box completely with the number or write close to the left side to prevent anyone from adding an extra number, such as changing "$1,000" to "$11,000" by squeezing in that extra "1."

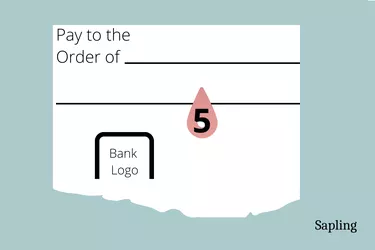

Next write the dollar amount in word format (on line 5) to match the numerical amount. You have various options here. You can write "One thousand dollars even," "One thousand and 00/100" (which means there are no cents payable) or just "One thousand" with a line running from the word "thousand" all the way to the printed word "dollars" at the end of the line. The idea is to make the cents amount as clear as the dollar amount.

Make a Note to Yourself in the Memo Line

You can write a note on the memo line in the bottom left portion of your check (line 6). This step is optional, not mandatory, but it can be useful to jot down any additional information to clearly specify what the check is paying for. You might write "Rent September 2022" or "Invoice #83480." This can be helpful for the individual or entity to whom you're writing the check as well.

Sign the Check

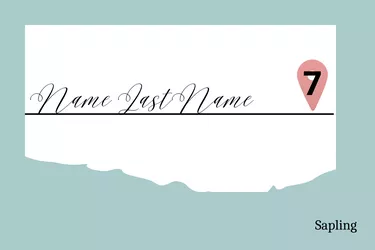

Sign your name on the signature line in the bottom right of the check (line 7). This makes the check official. The payee can now present it for payment.

The $1,000 Question

There's no limit to the amount of money for which you can write a check, provided that your account balance is enough to cover it. This means that the funds are actually available in your account, not necessarily that you've simply added a deposit to your check register or made note of it in your checkbook. You'll want to be sure that the money you deposited has cleared and you're free to use it.

As for that $1,000, many businesses will ask that you get a cashier's check for large amounts of money. The bank guarantees payment of cashier's checks, according to Navy Federal Credit Union. There's no risk to the business that your check will bounce. For example, an escrow company probably won't accept a personal check for an earnest money deposit when you buy a house.

Cashier's checks cost about $10, but you can get a refund if you lose it and the bank will issue a new check. You have no such protection if you lose a personal check or cash. A cashier's check is definitely the safer option for large amounts of money.