Identity theft and check fraud have become rising concerns in this millennium, and personal checks can provide a bounty of information to thieves and fraudsters. Each check you write can include information that can aid and abet anyone who wants to seek access to your personal finances, checking account or to convince lenders and other entities that they're actually you. Your checkbook might be stolen, providing the thief with choice tidbits of your personal information because you had it printed on each of your personal checks for the world to see.

But not all the information that appears on a check is mandatory. As the account holder, you have a right to determine exactly what appears on your checks, at least to some extent.

Video of the Day

Video of the Day

Options for Using Your Name

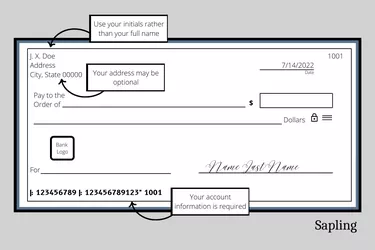

Your name (the payee's name) and address typically appear printed at the top left corner of your personal check. The Tarleton State University Police Department cautions against advertising this information. You have a few options if you want to avoid it.

Consider using your initials, such as, "J. X. Doe" instead of "John Doe" or "Jane Doe." A thief won't know if that's how you actually sign your checks, but your bank will.

Including Your Home Address

You're not legally required to print your address on your personal checks, according to SoFi. You might use your work address instead or use a P.O. box if you have one. You also have the option of just leaving your address off your check entirely. It makes no good sense to tell total strangers where you live when you make a payment to them by check. You can always provide it separately if a merchant or other payee requires it.

What About Your Phone Number?

Including a phone number on your checks is also optional. You can write it in if a payee wants to be able to contact you for some reason, maybe because they're concerned that your financial institution won't honor and pay your check. You might also use your work phone number instead, assuming your employer agrees.

It can have devastating results if your Social Security number falls into the wrong hands, so USA.gov strongly advises against having it printed on your checks. Think twice if someone you're paying by check tells you that they need it because, other than the government, very few entities do.

The same caution applies to your driver's license number. No one really needs that in order to accept a check from you.

Your Account Number Is Required

Your account number, your bank's routing number and your check number (found in the upper right corner) are three pieces of information that you have no control over. The routing number identifies your bank, and your bank account number tells your bank what account the check should be paid from, says Baton Rouge Telco Federal Credit Union. That's pertinent information for processing the payment of your check.

These numbers must appear at the bottom of the check, along with the number of your check, which also appears in the top right-hand corner.

Consider Other Options

Writing a check for payments is rapidly becoming a thing of the past. While you might still need a check for certain tasks like direct deposits, you have numerous other options if you don't want to have to deal with any of your personal information being broadcast to anyone to whom you make a payment.

National Public Radio points out that you can almost always use PayPal or Venmo for certain types of payments. InCharge Debt Solutions recommends making electronic payments from your bank account. These payments are covered under the Federal Reserve's regulations, whereas paper checks are not. Banks must investigate and refund your money within 10 to 45 days if it turns out that an electronic payment is subject to fraud.

And, of course, you can always use a credit card. But then you have to determine how you're going to pay your credit card lender. Using a debit card is usually safe because it's effectively a form of electronic transmission.

- Baton Rouge Telco Federal Credit Union: How to Read a Check: Knowing What It All Means

- Tarleton State University Police Department: Help! My Identity Was Stolen!

- National Public Radio: Check Fraud Is On the Rise. Here’s What You Need to Know and How To Avoid It

- USA.gov: Identity Theft

- InCharge Debt Solutions: Personal Checks vs. Electronic Bill Payment: Which One Is Safer?

- SoFi: Can I Use Checks With an Old Address?