Each month you send in your hard-earned money in to make your mortgage payment. When the lender receives the payment, part of it is applied toward interest charges, another part towards the principal balance on the mortgage loan.

So, what is the principal loan amount and why is it so important? The principal refers to the original loan amount you took out. It's important since the faster the principal balance is reduced, the faster the property secured by the mortgage becomes yours. Understanding the characteristics of the principal balance of a mortgage loan will help you determine how to manage its reduction.

Video of the Day

Video of the Day

Consider also: How to Buy a House If You Are 18 Years Old

What Does Principal Balance Mean?

The principal balance on a mortgage loan is the outstanding balance due on the original loan amount. As a principal balance example, consider that if a mortgage was originated in the loan amount of $200,000, then the first mortgage statement will show the principal balance of $200,000. Over time, assuming you are making regular monthly mortgage payments, and that you are not making interest-only payments, the principal balance will decrease.

Finding the Principal Balance

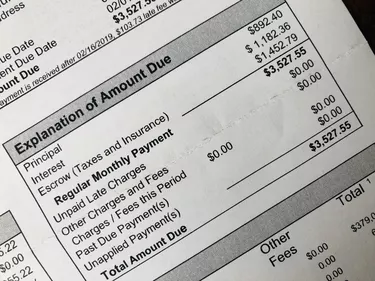

Principal balances should be clearly displayed on your monthly paper or online mortgage statements. The mortgage lender or servicer will show the total principal balance remaining, also referred to as the current loan amount, and may show the original loan balance.

The statement usually shows a monthly payment breakdown, outlining how much of your total monthly mortgage payment goes towards paying down the principal balance, and how much goes towards that month's interest owed to the lender. The monthly interest charge is the amount the lender is charging for lending you the mortgage amount and allowing you to pay it back over a period of time.

Consider also: Mortgages & Taxes: What You Need to Know

Understanding How Amortization Works

As you keep paying your mortgage every month, the loan balance will eventually reach zero. So if a mortgage is amortized over 30 years, the lender will schedule enough monthly principal and interest payments for the borrower to pay the full loan balance within 30 years.

After the principal balance is paid back completely, the mortgage company releases the deed, or full security, to the owner, who will now own the home free and clear. Amortization schedules typically allow for a larger percentage of a monthly payment to go towards the principal balance as the loan matures.

Paying Down the Principal

Paying extra towards a principal balance will result in your mortgage being paid off faster, leading to full ownership of your property, and will save you from future interest charges. If a monthly payment is $1,200 and you send in $1,350, the lender should apply the additional $150 towards the principal balance.

There are online tools that show the effect of additional payments on the life of the loan. For example, making an extra payment each year on a $300,000 30-year mortgage with a 4.125 percent interest rate can help you cut around five years off the payment schedule.

Consider also: How to Make a Mortgage Payment to PHH

Understanding Mortgage Rules

Be sure that your monthly payments are sufficient to cover interest and to pay down the principal balance. Fixed-rate and most adjustable-rate mortgages schedule principal and interest accordingly. However, some mortgages with interest-only or negative amortization features will only require the interest, or monthly finance charges, to be paid, with no principal reduction, and may result in money being added back to the principal balance.

You'll want to be careful, as these risky payment options do not build equity and, if the value of the home does not increase over time, could also result in the principal balance being higher than the property's value.