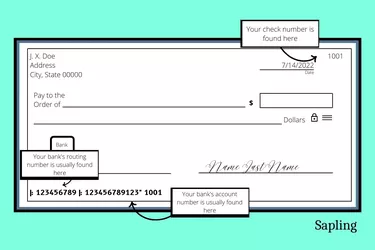

The critical bank numbers printed on a check – in addition to those you write in yourself – all appear along the bottom of the check, separated into three groups. Finding them is the easy part.

Many banks print their routing number first, at the left side of the check, followed by your account number then by the check number. But some switch the order of the numbers around. The one thing you can count on is that they'll appear at the bottom of a personal check, although some may appear elsewhere on the check as well. Those on the bottom are printed using magnetic ink character recognition, or "MICR," so they're virtually indelible. They can't be erased or removed.

Video of the Day

Video of the Day

The Routing Number

Routing numbers were first invented by the American Bankers Association in 1910. They're sometimes referred to as ABA numbers or transit numbers. No two banks' routing numbers are the same. This number identifies the bank, credit union or other financial institution at which the checking account is held and from which the check will be paid. It directs online banking, electronic processing and direct deposits.

Only state and federally chartered financial institutions are eligible for routing numbers. They must maintain a master account with the Federal Reserve Bank. You can identify the routing number at the bottom of your check whether it appears to the left, the right or in the middle because it's always made up of nine digits. You'll also see this symbol on either side of it: "I :"

Your Bank Account Number

Your account information or number is usually the second set of numbers at the bottom of a check. It designates the account from which the bank will withdraw the funds to pay and honor the check. It usually appears in the middle between the routing number and the check number, and it has its own little symbol that will appear to the right of it: "I I '"

Your checking account number will be longer than your bank's routing number, and it's yours and yours alone. Unlike the ABA routing number, no other account shares it.

The Check Number

The check number is one of the little informational tidbits that will most likely appear twice on your check: once at the bottom with the routing number and account number, and again in the upper right corner of the check. The numbers that appear in each place must match. One of them might begin with one or more zeroes, but the last digits will be identical.

This number is for your personal use. It helps you keep track of and a record of payments you've made by check.

The Branch Number

Finally, you might see an additional number up there at the upper right corner of your check, directly beneath your check number. This is the branch number, and it's sometimes referred to as a fractional number. It denotes the bank branch where you hold your account, and it will match some of the digits in the routing number because the routing number also designates this information.

Doublecheck So You’re Sure

You'll want to be very sure that you're using the right numbers if you're entering this information for purposes of making an online bill payment, wire transfer or to arrange direct deposit of your paycheck into your bank account. Don't mix them up because this can stall either process.

The ABA provides a tool on its website that you can use to look up a bank's routing number. You can also check your financial institution's mobile banking app or a bank's website to confirm the information. It should all be provided there, as well as on your paper bank statement if you're signed up to receive one by mail each month. Or you can simply call your bank or credit union to make sure you have the numbers right.