What if you paid your rent with a check out of your checking account and it cleared the bank or credit union, but then your apartment management company said that they never received the check. How would you provide proof of payment?

You would need a copy of your check to provide proof of payment. It's easy to request from your financial institution.

Video of the Day

Video of the Day

Canceled Checks Show Proof of Payment

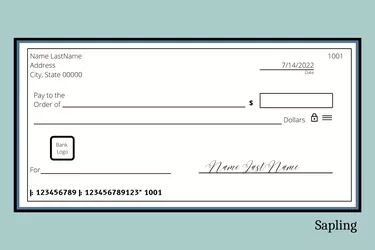

When you pull out your checkbook and write a personal check, the payee's credit union or bank sends it to your financial institution. It's then charged against your bank account. At that point, your personal check turns into a canceled check.

A copy of a check is generally a canceled check. It shows the endorsement of the payee on the back of the check. The canceled check or copy of the check is housed at your financial institution.

When someone wants proof of payment via a copy of a check, they are in essence asking for a canceled check from your financial institution. They don't mean copies of blank paper checks from your checkbook.

Online Banking and Mobile Banking

It used to be standard for financial institutions to return your paper canceled checks with your bank statement monthly. And although state law requires that a bank or credit union keep a copy of the original check for seven years, most don't automatically send them to you.

One reason for the change is online banking and mobile banking. You can go online to see a digital image of your canceled check. If your financial institution has a mobile app, you can use that to see your canceled checks. For instance, Bank of America keeps an online digital image of your canceled check. A depositor can download it for up to 36 months at no charge.

When looking for a copy of the check online, it helps if you have a check number and the date of the personal check that was written. You should be able to find this in your checkbook registry.

You will not need your routing number. The routing number designates your financial institution, and you are already in your online banking account.

When you locate the needed copy of the check from the digital image, many financial institutions will let you download it so that you have a paper copy. You will note that it is stamped by the financial institution on the back of the check. This designates that it is canceled and cannot be used again.

Does a Local Branch Provide Canceled Checks?

Sometimes, you can request a canceled check from a teller at your local branch. If you didn't find your check through your online banking account, you should go this route. You'll need your account number and the check number. Look in your checkbook for that information. Once more, you won't need your routing number.

You may not receive the original check, but the teller can download and print a copy of the canceled check. There will probably be a fee to do this. But this will give you proof of payment for your landlord.

Common Check Questions

Requesting a canceled check shouldn't be a hardship. But it may not be very clear if you don't do it consistently. Here are a couple of frequently asked questions:

Is a Copy of a Check Legal?

A copy of an original check is not legal tender. The canceled check has already been used and can't be used again.

What Does a Copy of a Check Mean?

Once the payee has endorsed the back of the check, the original check goes from the payee's bank or credit union to your financial institution. Your financial institution stamps the back of the check, designating it is now a canceled check. This is what a copy of a check means.