A personal check is a paper document directly connected to your bank account that you can use as a form of payment. Your account number and your financial institution's routing number are printed on them. When you complete a personal check and present it as payment, the funds are withdrawn from your checking account. You must have sufficient funds in your account to cover the amount. Once the check has been deposited or cashed, it is canceled by the bank, meaning it cannot be used again.

Do People Still Use Personal Checks?

Video of the Day

Personal checks are not used as often as they used to be. In the late 1990s, the number of check payments in the U.S. peaked at 50 billion, according to a 2008 Atlanta Fed historical study of checks. By 2018, American consumers used less than a third of that amount. However, that is still 14.5 billion checks.

Video of the Day

According to a 2018 Atlanta Fed study, today's check usage tends to be for higher-ticket items and large payments such as utilities, house renovations, rent, down payments and charitable donations. Checks take longer to process than other forms of payment, but a canceled check can serve as its own receipt.

When and Where to Pay by Personal Check

You can pay by personal check almost anywhere you can pay by debit or credit card. Some businesses may refuse to accept checks because of the risk of bounced checks and the amount of processing time.

Barring any exceptions, you can mail a check for utility payments or credit card bills, pay your rent or mortgage or take care of your weekly grocery trip. You can even exchange money between people by using a personal check. Think of it as the paper version of Venmo or PayPal, without the instantaneous deposit into your account.

Features of a Check

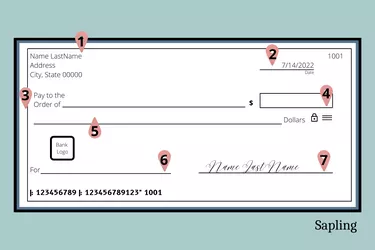

Field | Image Item # | Description |

|---|---|---|

Personal information | 1 | Pre-printed name and address |

Date | 2 | Fill in with current date |

Payee | 3 | Write in the recipient's name |

Amount in numerals | 4 | Enter the amount in numbers |

Amount in words | 5 | Spell out the amount in words |

Memo | 6 | Write what the check is for |

Endorsement | 7 | Sign the check |

How to Write a Personal Check

- Fill in every field. Every field on the check must be filled out for a check to be valid and secure, and your contact information should be up to date. The personal data should match when you present a photo ID with your check.

- Endorse the check. The check should be dated and endorsed with your signature. Be sure to fill in the payee line, or anyone who finds the check can cash it.

- Check the numbers. Make sure the amount in numbers on the check and the amount in words match. If there is a discrepancy, the amount spelled out in words will be used, according to the Consumer Financial Protection Bureau (CFPB).

Keeping Track of Checks You've Written

Your checks will come in a book of typically 100 checks. If you have side-tear checks, the stub that remains in the book is where you can record the check you wrote and tore out. Record the name of the payee, date and amount.

If you have top-tear checks, you will find a little booklet with deposit slips and a check register inside your checkbook cover. Fill in the check details and keep a running tally of the funds in your checking account.

To make checks easier to track, use them in consecutive check order.

How Can I Cash a Personal Check?

You can cash a check at your bank with a photo ID. If the account the check is written on has sufficient funds, and your account has enough funds to cover if it bounces, you should be able to receive the funds right away. Or, you can take the check to the issuer's bank or credit union and present it for payment with your photo ID.

If you are writing a check to yourself for cash, you can cash it at your bank with a photo ID.

How Long Does a Check Take to Clear?

Some personal checks can be cashed right away, but others may take up to two business days or more, depending on the type and amount of the check and the financial institution's policy.

If your account and the check writer's account are at different banks, your bank might first require you to deposit the check and have it clear before accessing the funds.

Are Personal Checks Free From Your Bank?

While some financial institutions provide free personal checks with preferred checking accounts, many require you to purchase your checks. Depending on where you buy your checks, the cost can range from $5 to $50 or more for a box of 100.

How Do I Order Checks?

You can order new checks or reorder checks directly from your financial institution or a third-party vendor, such as Deluxe Checks, Harland Clarke, Walmart Checks or an online seller.

Personal check designs range from plain blue to custom check designs with monograms. Bestseller options include floral checks, scenic checks, animal checks, religious checks and even Disney checks.

New checks tend to cost more at a bank or credit union, but if you go with a less expensive third-party vendor, ensure the company is reputable before you provide your routing and bank account numbers for the order.

Frequently Asked Questions About Personal Checking

Some FAQs about checking include:

How Can I Avoid Check Fraud?

From legitimate checks that are stolen out of the mail to bad checks presented as a scam, be aware of the potential for fraud. You might opt to purchase high-security checks with security features that offer check fraud protection.

Always ensure that every field has been filled out with permanent ink when writing a check. Avoid accepting checks from someone you don't know, especially for a significant amount.

What Are Some Alternatives to Paper Checks?

You can also use an electronic transfer or debit card to pull funds directly from your checking account. For large purchases, you may want to request a bank check, which is written and secured by the bank after the funds are transferred from your account to the bank.