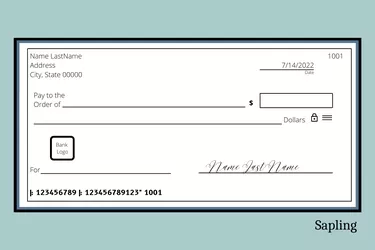

Though the world has moved increasingly to digital and touchless payments, using a paper check still has some advantages.

Pros and Cons of Paying by Check

Pros | Cons | |

|---|---|---|

Security |

|

|

Convenience |

|

|

Cost |

|

|

Proof of Payment |

|

|

Video of the Day

Security

Paying with a personal check, especially when you are making a significant purchase or paying off a large bill, is much more secure than handling cash.

Video of the Day

For instance, if you lose your checkbook or an endorsed payroll check, you can protect your checking account by calling the bank and stopping payment on any checks written. You can even stop payment on an e-check or ACH payment. But if you drop an envelope of cash on your way to make a payment, there is no such banking service to protect you.

Mailing a check is safer than sending cash, too, because if a check ends up in the wrong hands, someone will have difficulty cashing it without showing an ID.

On the other hand, checks can be subject to fraud. Through a process called "check washing," thieves can change the payee's name on a paper check and attempt to deposit or cash it. Checks also contain personal information about the account holder including financial institution, bank account number, home address and other identifying information. If you ever lose a personal check, report it to the bank immediately.

Convenience

You probably don't want to carry cash when making large payments. A checkbook is easier to tote. And if you need to pay bills by mail, it's simple to write out paper checks and send them off. Most merchants still accept personal checks, even if other forms of payment are preferred and encouraged.

While businesses are not required to accept personal checks as a method of payment, most do. Some small businesses may not want to risk a bounced check and the cost of verification services for check payments.

For business owners, checks are widely used for convenience. According to a study by the Atlanta Fed, 60 percent of paper checks in the U.S. are written by businesses and the government. For small business owners and large corporations, business checks may still be used to pay contractors, purveyors and payroll. And part of the convenience is that they serve as a paper trail.

Proof of Payment

When you write a paper check, or even send an electronic check or ACH payment from your checking account, you create a paper trail that provides proof of payment. If you're disciplined and include the details of each personal check you write in your check register, you'll have a personal record of which check went to whom, which helps with budgeting and managing your personal finances.

You have proof of payment as soon as the payee cashes or deposits your check or the payee's bank processes your ACH transfer. The canceled check and the recorded transaction on your bank statement or online banking system prove your payment was made and received.

Credit cards also provide an electronic paper trail, but when you pay with cash, it's trickier to have clear proof of a payment made.

Cost

One of the main advantages of writing checks instead of using a credit card is that your check payment is directly withdrawn from your checking account. There is no credit card interest rate to worry about. When paying bills with an e-check online, there is often no transaction fee or processing fee, while credit card payments often get hit with a convenience fee.

Oftentimes, the only cost of using checks is literally the paper they are printed on. If you have standard-issue paper checks, the cost can be very minimal. Depending on the type of bank account you have, your financial institution may even provide a certain number of complimentary checks.

What Are the Disadvantages of Using Checks?

The main disadvantages of checks involve cash flow, overdraft fees and processing time.

If you don't consistently keep a balance in your checking account that safely covers the checks you write, you may run into overdraft fees due to insufficient funds. These can be very costly, especially if your account is negative when several checks hit the bank at once.

Along the same lines, writing checks instead of using a credit card can come down to cash flow. If personal finances are tight, you may be hesitant to draw down your checking account balance. Then again, this issue also impacts the use of a debit card or a party-to-party payment platform like PayPal since those are also drawn from a bank account.

Lastly, the FDIC repeatedly reminds consumers and merchants that frauds and scams with checks are a growing issue. This is why it takes time for a bank or credit union to process a check and make the funds available to you.

- Federal Trade Commission (FTC): How to Spot, Avoid and Report Fake Checks

- FDIC: FDIC Consumer News: Beware of Fake Checks

- Office of the Comptroller of the Currency: Can the Bank Pay a Check After I Place a Stop Payment on It?

- Consumer Financial Protection Bureau (CFPB): How do I stop payment on a check?

- Federal Reserve Bank of Atlanta: U.S. Consumer's Use of Personal Checks