Even though people use checks from their bank account less often than they used to, it's still critical to know how to endorse one and how to read the front of the check and the back of the check. After all, even most mobile deposits still require a photo of the back of the check. You will need to know how to read all parts of a check, including the endorsement area. That way, whether you use online banking or in-person services, you will know you've done everything properly.

What Information Is on the Back of the Check?

Video of the Day

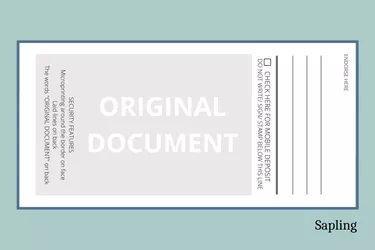

There are three main areas on the back of a check: the blank endorsement area, the security screen and the security box, explains Baton Rouge Telco Federal Credit Union.

Video of the Day

- The endorsement area is the part at the right with the signature line. The recipient or depositor needs to sign, even for mobile deposit only on a mobile banking app. There may be numbers in the endorsement area as well, but you don't have to worry about those. They're there to prevent check fraud.

- The security screen or security area is for bank or financial institution use only. Do not write or make marks in this area.

- The security box is usually on the left side of the back of the check. It contains a warning to deter check fraud.

How to Endorse a Check

If someone wrote or cut you a paper check, you must endorse the back of the check in the endorsement area. You need to use your regular signature before depositing it to your checking account, savings account or other account. U.S. News & World Report Money explains that this is called endorsing a check.

In some instances, the payee may want to sign the check over to someone else to deposit it into their account. If you want to do so, write "pay to the order of" under your signature and then print the person's name. They can sign it, but they don't need to do so.

Another type of endorsement is called restrictive endorsement. This is when you write "for deposit only" above your signature (still in the signature area). This means that the check can only be deposited into your account and cannot be cashed.

What Happens if You Write on the Back of the Check?

The only place that should have any writing on the back of a check is the endorsement area. Also, the payer has no reason to write on the back of the check, so if you're writing a check, don't worry about it.

If other parts of the check's back contain writing, the check might not be honored. That's bad news whether you're the payer or payee. If you accidentally write on the back of one of your checks, black out the routing and bank account numbers and throw it away.

Common Check Questions

Some other frequently asked questions about the back of a check include:

What Is the Back of a Check Called?

There is no special name for the back of the check. It is made up of the endorsement area, security box and security screen.

What Do I Write on the Back of a Check to Someone?

As the issuer, you do not need to write on the back of the check.

What Is the Difference Between the Front and Back of a Check?

The front of the check is where the issuer provides the necessary information to authorize their bank to transfer money to the payee. The back of the check is where the payee accepts the funds by endorsing the check before depositing it or cashing it.

What Is the Purpose of the Back of a Check?

The back of the check is intended for endorsement to authorize regular or mobile check deposit or check cashing.