FMHI, or federal medical health insurance, is another name for the Medicare tax. The FMHI tax is levied on income along with FICA (Social Security) and federal income tax. Added to premiums paid by consumers eligible for Medicare, FMHI tax receipts are used to pay for health care for senior citizens, people with disabilities, federal workers, and (through Medicaid) those who cannot afford health insurance. The funds raised by FMHI taxes are administered through the Social Security Administration.

Identification

Video of the Day

FMHI is a federal payroll tax designated by law to be used exclusively to fund Medicare and Medicaid health-care programs. Employees and employers each pay part of the tax. Unlike with most taxes, there are no deductions or income limits. FMHI tax is levied on all earnings. The percentage for FMHI tax is set by Congress and is subject to change.

Video of the Day

History

Official interest in a national health insurance system dates back to President Harry Truman in 1945, when he proposed legislation to create one. Congress failed to pass Truman's proposal and it was not until the Medicare Act of 1965 that national health insurance was enacted into law. The following year, FMHI tax began to be levied. The initial tax rate was 0.35 percent each for workers and employers. From then until 1985, the Medicare tax rate was increased several times by Congress until it reached its current level in 1985. The rate increases were partly due to rising health-care costs, but also to expansion of the program. Over time, items like physical therapy and hospice care were added. In 1983-1984, coverage for federal workers was added to Medicare.

Payroll Tax

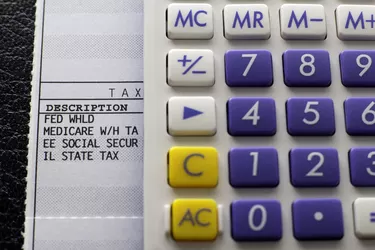

Calculating FMHI tax is extremely simple. All that is necessary is to multiply the employee's gross wages by 1.45 percent. That amount is withheld from each worker's paycheck. The employer adds an equal amount. On some paychecks and related documents, you may see Medicare and Social Security listed as a combined rate (7.65 percent for the employee's share). Since both are fixed-percentage taxes, this is often done for convenience, but they are separate taxes.

Self-Employment Tax

Self-employed persons are responsible for paying the full amount of FMHI tax of 2.9 percent (the 1.45 percent workers pay, plus the 1.45 percent employer share).To calculate FMHI self-employment tax, you start with the person's gross profits (income after business expenses) and multiply by 0.9235. The result is called net earnings. The FMHI tax (along with federal income tax and Social Security tax) is levied on net earnings. Determine the amount by multiplying net earnings by 2.9 percent.

Function

FMHI tax is one source of funding for Medicare, along with premiums paid by Medicare consumers. The enabling legislation restricts Medicare spending to funds derived from these sources only. There are four components to Medicare that FMHI taxes subsidize. Medicare Part A pays for hospital and long-term hospice or home care. Part B helps pay the cost of physician care and outpatient care. Medicare Part C gives those insured by Medicare a choice of care plans and providers. Medicare Part D was signed into law by President Bush in 2003 and is the newest addition. Part D is a prescription drug plan. It is optional for those covered by Medicare but participants must pay an additional premium for Part D.