The Internal Revenue Service provides numerous payment options if it turns out that you owe money to the IRS when you complete your federal income tax return. These options include checks and money orders. But you'll want to take care that you get the process just right.

Make sure that your IRS payment includes the information the tax agency needs to associate you with the remittance if you opt to write a check for your balance due. Double-check to be sure that you're sending the check to the IRS at the correct address.

Video of the Day

Video of the Day

You also have options to pay online, wire money to the IRS and even pay in cash if you decide to e-file your return.

Paying the IRS by Check

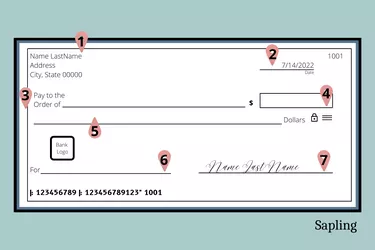

The numbers in parenthesis correspond with the check's image to help you identify where all the information should be entered. First, the IRS advises that you make your check payable to the U.S. Treasury or the United States Treasury on the "pay to the order of" line (3) if you decide to mail a paper check to the IRS. Don't staple or paper clip it to your return or any other forms or documents you're including.

Your check should show all necessary information to identify your bank, such as your account number and its routing number. These are the numbers that appear along the bottom of your check. But make sure your check also includes some additional information.

The IRS advises including your name and address, but this should already be printed at the tip of your check. (1) Include a phone number where you can be reached during the day in the memo field (6), as well as your Social Security number (SSN) or other taxpayer identification number, the tax year and the tax form with which your payment is associated. For example, you would enter "2021 Form 1040" if you're sending a payment for the 2021 tax year in 2022.

Write the numeric version of your payment in the box or space provided next to the payee's name (4), then write out the amount on the line beneath (5). For example, you might enter "745.00" in the numeric field, and "seven hundred and forty-five" on the line beneath.

Sign your check at the bottom right corner. (7)

Where to Mail Your Check

Consult the IRS website to figure out where to mail your check. The agency posts links for each state depending on whether you're submitting your tax return with or without payment. The address will vary based on what tax form the payment is associated with. You can contact the IRS for help if you don't see instructions that pertain to your particular situation.

Follow the instructions on any notice you might receive from the IRS asking for payment due in a previous year. This address may be different from the one where you would submit payment with your tax return.

You may want to use a United States Postal Service product that will give you confirmation that the IRS has received your payment and that it was sent. The IRS considers returns filed on time if they're mailed and postmarked by the due date, according to the USPS. You can get a certificate of mailing service from the USPS that will attest to when your papers were mailed, or you can request a return receipt that will show when it was received by the IRS.

Paying the IRS Online or Electronically

You can also pay the IRS online using a checking account or savings account. Just go to IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS). Fees will typically apply if you pay by debit card or credit card.

You can also provide bank account information specifying the account from which the funds should be withdrawn when you file your tax return. This should be an option if you work with a professional tax preparer or if you use tax prep software. This is also an option if you're expecting a tax refund from the IRS and you want the IRS to direct deposit the money to your account rather than mail you a check.

Wiring Money to the IRS

You can ask your bank to wire money to the IRS. Contact your financial institution for details. Your bank may charge a fee, and you may have to print out and complete a Same-Day Taxpayer Worksheet from the IRS website that the bank will transmit with your payment.

Paying in Cash

You can pay the IRS in cash if you prefer. This option is often available at retail and convenience stores for a fee, and the IRS provides a list of participating stores. But call ahead to find out if the location you're considering provides this service.

Some IRS offices accept cash payments as well. The IRS provides a tool on its website to help you find a location near to you.

If You Can’t Pay in Full

The IRS offers various types of relief if you just don't have enough money on hand to pay your balance in full. One of these is an IRS installment agreement. This is a payment plan that allows you to divide up your balance due over up to 72 months (six years) if you qualify.

Watch Out for Scams

Fraudsters sometimes impersonate the IRS and demand payment of bogus taxes and fees. Don't panic if you're contacted by someone claiming to be the IRS, even if the individual on the phone threatens prosecution or jail time. Reach out to the agency directly to confirm that the contact was genuine.

And keep in mind that the IRS will never, ever email you or send you a text message asking for payment or information. Receiving either one is a bright red warning that you're being scammed.

Keep in mind that your check will have your Social Security number, contact information and bank account information on it, so make sure that it's handled and mailed securely. Ideally, you should mail it at your local post office or place it directly into the mailbox outside the office.