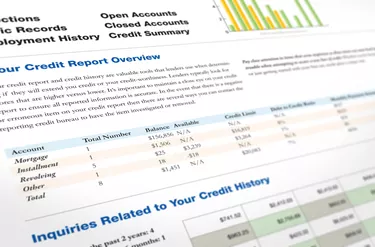

A record of a person's credit history is compiled in the form of a credit report. This report forms the basis of a person's credit score. If a person fails to pay back a debt and allows it to remain delinquent for too long, the creditor may write off the debt completely. In this case, the debt is listed on the debtor's credit report as a "charge-off." Since a charge-off depresses a person's credit score, you might want to have one reversed.

Charge-Offs

Video of the Day

A charge-off is an indication that the creditor who issues the debt does not believe the debt can be collected and is no longer attempting to do so. All charge-offs will lower a person's credit report score because the person failed to pay back the money that he agreed. This provides an indication that the person is at a high risk of defaulting on a loan. This means lenders will be more likely to charge him higher interest rates.

Video of the Day

To convince a creditor to reverse a charge-off, the debtor must enter into negotiations with the credit card company.

Reversing Charge-Offs

Because charge-offs lower a person's credit score, you could want to get a charge-off reversed. The only way to reverse a charge-off is to get the creditor to tell the company that compiles the credit report that it no longer considers the debt written off. At this point, the credit report will be changed and the charge-off listing will now describe the debt as being active or, if the debtor has paid it, paid off.

Negotiations

To convince a creditor to reverse a charge-off, the debtor must enter into negotiations with the credit card company. The debtor should offer to pay the debt back in exchange for the creditor removing the charge. The creditor will then change the status of the debt on the credit report to "paid as agreed." In some cases, the debt may also be listed as "paid" or "settled," which will not raise the individual's credit score as much as a listing of "paid as agreed."

Considerations

A creditor is not required to change the listing of a charge-off on a credit report, even if the person pays back the debt. For this reason, Bankrate.com suggests that before paying any money, the debtor has the creditor agree in writing to reverse the charge-off.