The Internal Revenue Service (IRS) offers tax deductions for a number of specified depreciable asset categories. One such category is qualified leasehold improvements, which the IRS defines as any improvement to a commercial property that meets four distinct conditions. Specific types of assets are not eligible for deduction, but most internal building improvements are.

Conditions and Exclusions

Video of the Day

Qualified leasehold improvements must meet four conditions to be classified as an eligible depreciable asset. The improvement must be stipulated in the lease and financed by either the lessee or lessor. The part of the building containing the improvement must be solely occupied by the lessee. The improvement must be made after 3 years of the building's initial use. The property must also fall under the category of Section 1250 property, as defined in Publication 544, Chapter 3.

Video of the Day

The IRS also specifies four ineligible improvements, including the enlargement of a building, the addition of escalators or elevators, the addition of a structural component in a common area and the addition of an internal structure in a building.

Remodeling Improvements

Improvements in the space and layout of the building are eligible for deduction. Examples of eligible improvements include new walls, doors, ceilings, floors and other components used to create new space inside the building. New bathrooms, remodeled lobbies and new offices fall under this category as well. Structural changes may not be considered improvements, however, if they are simply redesigns. A space redesign can add value to a building if it increases the attractiveness or capacity of work areas.

Energy Efficiency

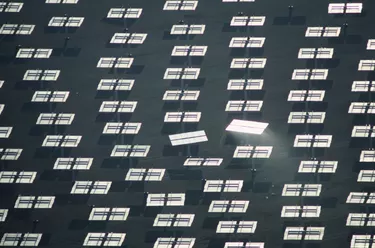

Improvements for energy efficiency are generally qualified leasehold improvements and may allow you to take advantage of other tax incentives as well. Energy efficiency improvements to heating and cooling systems, ventilation systems, lighting systems and windows all fall under this category.

Infrastructure

Improvements to the vital infrastructure of a building, including electrical, plumbing and security systems, are considered qualified leasehold improvements. These types of improvements can increase the value of a property by making vital building functions safer and more reliable for lessees. Certain infrastructural improvements may fall under the energy efficiency category as well.