If you're wondering where your sales tax goes, you're not alone. Many voters want to make informed decisions regarding this topic as it comes up during elections. A large percentage of state and local sales tax money typically goes to the general fund, but some is earmarked for special purposes. State and local governments have authority from the federal government to levy taxes, and the law gives them considerable leeway how they raise and spend tax dollars.

Video of the Day

Video of the Day

Where the Money Goes

The General Fund

Most state and local sales tax revenue goes to general government expenditures because it is added to the general fund, along with money from other sources, such as licensing fees and income taxes.

Allocation of State Revenue

State sales taxes play a major role in supporting education and health care because more than half of state funds go to support these needs, according to the Center on Budget and Policy Priorities.

In their findings in 2016, 26 percent of state money went to K though 12 education, 17 percent paid for children's health insurance and Medicaid, and higher education received 15 percent. Transportation got 6 percent, while corrections received 5 percent. Other public assistance received 1 percent, and all other expenses totaled 32 percent.

Some of these other spending categories and sales tax uses include:

- public pensions

- public employee and retiree health care

- environmental projects

- recreation

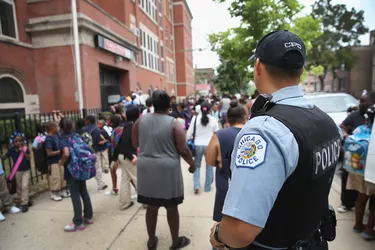

- police

- fire protection

- jails

- foster care

- medical facilities

The states also send money from sales taxes and other sources to local governments to supplement local tax revenue.

Specific Sales Tax Projects

Each state or local district typically earmarks portions of the sales tax directly for special purposes. In Oklahoma for example, portions of the sales taxes go to teachers' pensions and tourism. In Utah, some local sales taxes are specifically directed to rural hospitals, arts funding, mass transit and recreation. Often voters have the opportunity to approve or reject sales tax increases designated for specific local needs.

Some jurisdictions have earmarked sales taxes for:

- libraries

- zoos

- parks

- police forces

- jails

- museums

- science organizations

- civic center construction projects

Consider Also: Who Must File Income Taxes?

State and Local Tax Rates

As of 2021, 45 states had sales taxes – all except Delaware, New Hampshire, Montana, Alaska and Oregon. In addition, 38 states, including Alaska and Montana, allow local sales taxes. In some states, you pay a consumer sales tax as a percentage of your purchase.

In other states, the business owner pays a percentage of the sale as a vendor tax, but this is passed on to the customer as a sales tax. Some states have both vendor and consumer taxes, and in this case, the consumer pays the combined total as a sales tax.

Consider Also: Schedule A: Instructions on How to Itemize Deductions

What Sales Taxes Cover

Many states and localities tax both goods and services, so the tax is often called a sales and use tax. Depending on the jurisdiction, these taxes may apply to tangible goods, services such as electricity, hotel charges and restaurant dining.

However, many states and cities exclude items that are necessities – such as food from grocery stores. Schools and religious and charitable organizations are also exempt from these taxes in some states, according to the U.S. Treasury.