Buying mutual funds through The Vanguard Group (Vanguard) is easy to do as long as you have the funds available to invest. Vanguard is a leading investment company that has a long track record of providing quality investment services to its shareholders.

Step 1

Understand what a mutual fund is. Mutual funds are run by investment companies. The investment company (Vanguard) raises money from shareholders and uses that money to invest in a wide variety of financial investments, such as stocks, bonds or money markets. When you purchase a share of a mutual fund, your money goes into the pool of the money raised and is invested into multiple investment vehicles. While you own one share of the mutual fund, the mutual fund owns multiple shares of multiple investments.

Video of the Day

Step 2

Recognize the appeal of mutual funds. When you buy a share of a mutual fund, your investment is much less volatile than investing in only one particular company. Also, the investment company hires experts to make the best financial decisions for the mutual fund, so you get the advantage of a financial planner for your investment without having to pay for one.

Step 3

Learn what Vanguard is. Vanguard is one of the largest investment companies and has a longstanding positive reputation in the business. The link to Vanguard's website is provided in the resources section.

Step 4

Explore the mutual funds offered by Vanguard. Vanguard has a wide variety of mutual funds available, some of which come with a greater financial risk (but also greater chance of profit) than others. The Vanguard website provides you with an overview of the options available. You can also call Vanguard and request that they send you a prospectus for each mutual fund you are considering.

Step 5

Talk with a Vanguard representative. You can speak with a Vanguard representative for free at 877-662-7447 about your investment needs. Vanguard representatives are trained to answer a beginner's questions and will patiently explain everything that you need to know about investing with Vanguard.

Step 6

Select a mutual fund in which to invest. After you analyze the options, you are ready to choose a mutual fund. A Vanguard representative can help you find the best mutual fund to meet your financial goals.

Step 7

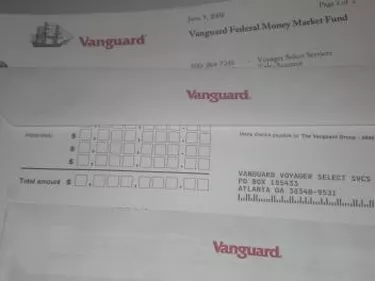

Fill out an application. You can fill out an application from the Vanguard website, open a new account by phone or ask a Vanguard representative to mail you an application. Be sure to provide all of the information requested.

Step 8

Send in your initial investment. Most Vanguard mutual funds require an initial investment of at least $3,000. However, some types of accounts (such as an Education IRA) have a lower initial investment requirement.

Tip

If you have any questions, call Vanguard at its toll-free number and talk with a Vanguard representative. Vanguard representatives are very knowledgeable about the investment process and the mutual funds that are available for investment, so they can walk you through the entire investment process.

Video of the Day