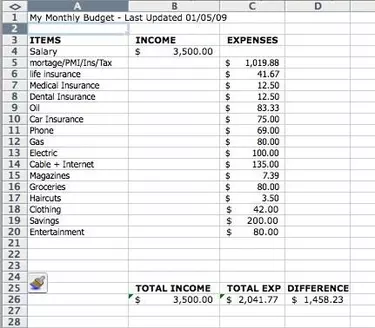

A home budget can help you live within your means, track expenses and see where your money goes every week, month or year. A spreadsheet program is helpful for organizing and totaling the numbers in the budget, or a budget can be written on a piece of paper and totaled by hand.

Income

Video of the Day

This is the money you make from work. Place the amount of your paycheck after withholdings on the budget to reflect accurately how much you take home every pay period.

Video of the Day

Monthly Household Expenses

These include expenses that relate to the upkeep of the household such as rent, mortgage, and utilities. Put each expense on a separate line.

Liabilities

Any loan payments you have should also be added to the budget individually. If there is extra money left over, you may want to increase the amount in this category to pay the loan balance off quicker.

Regular Weekly Expenses

Some expenses occur every week, such as food and gas. If you decide to calculate your budget based on monthly expenses, remember to multiple a weekly expense by 52 (for 52 weeks in a year) and then divide by 12 (for 12 months in a year). Multiplying by 4 is not accurate because not all months have four weeks in them.

Investments and Savings

Include any savings you put away other than what is deducted from your paycheck for retirement. You may be able to increase this amount if there is money left over.

Calculate the Difference

Subtract the total expenses from the total income to find out if you're living within your means. Extra income can be used to reduce debt or increase savings. A negative budget balance indicates cost-cutting measures must be taken.