The need to balance a retirement portfolio can be caused by several factors. The primary reason is the participant has reached retirement age and wants to reduce the portfolio's risk. Other reasons include the retirement plan is keyed to a specific trading strategy, greater portfolio diversification or that the participant wishes to receive a stream of income.

Realignment Occurs Toward Retirement

Video of the Day

The most common form of portfolio realignment of a 401(k) is when a participant reaches retirement. Participants should consider how much of the 401(k) will be needed for cash flow and how much they can afford to reinvest. Because of inflationary fears, the best way to ensure that the account grows with the rate of inflation is to invest in stocks. It is best to invest whatever cash will be needed in the next two years in cash or cash equivalents and the remainder be kept in stocks. Do not move all your money to cash in order to provide cash flow unless you have outside investments to use for expenses.

Video of the Day

Realign a 401(k) to Achieve Diversification

Diversification spreads risk among many asset classes in order to improve the steadiness of returns and the risk-to-reward ratio. 401(k) participants should consider a minimum of three asset classes, including stocks, bonds and money markets. Realignment should occur at least every quarter so dividends and interest payments are reinvested according to the ratio the participant has chosen for her asset classes.

Realignment as Part of a Strategy

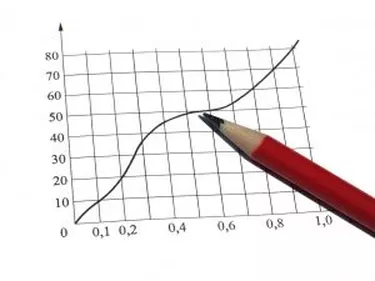

401(k) participants can use a specific stock strategy for investments. For example, 401(k) owners can decide to own stocks only when the Standard and Poor's 500 stock index is above the 200-day moving average line. Realignment should occur immediately, and the stock proceeds should go into bonds or money market accounts until the situation reverses itself. Such strategies often result in superior stock performance.

Realignment Based on a Time Frame

Realignment based on a quarterly or annual schedule should be avoided. Annual schedules are too slow to react to market events. Neither stocks nor bonds respond to calendar events and long-term trends respond not to calendar dates but to events. 401(k) participants need to use market events such as recessions or recoveries, not calendar dates, in order to effect timely changes to a portfolio.

Realignment to Take Advantage of New Opportunities

401(k) participants should redeploy assets within categories. Divide bond holdings, for example, into short, intermediate, and long-term bond funds. Stocks should be kept in growth and value categories. Consider stocks of both domestic and international origin. Consider owning a high portion of stocks that pay dividends.