Writing a postdated (PD) check is legal in Texas and all other U.S. states; therefore, cashing it before the date on which it is due for payment is not legal. However, many banks do cash checks presented before the due date, and may not be held liable unless certain steps have been followed to prevent them from doing so. Commercial organizations often state on their invoices that they do not accept PD checks and all checks will be deposited immediately. This is an exclusion clause to protect them from legal action.

What Is a Postdated Check?

Video of the Day

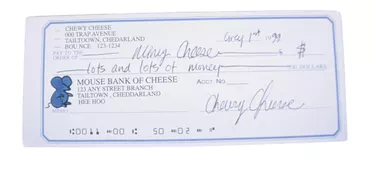

A PD check is a check written on a certain day but dated for a later date. The reason for writing a PD check is to provide payment to the recipient immediately, but the payee may only collect the money on the later date written on the check. In terms of the Texas penal code, a PD check constitutes a promise to pay the amount to the payee on a specific date. People usually write PD checks when insufficient funds are available to cover the check on the date on which the payee needs it.

Video of the Day

U.S. Law

Article 3-113 of the Uniform Commercial Code (UCC), which regulates sales and commercial transactions in all U.S. states, specifies that the date written on the "instrument" is what determines the date of payment, even if it the date on the check is later than the day when it is issued. Although legally a check is payable on demand, it is not payable before the date on the check.

Cashing PD Checks

In terms of the UCC ruling, therefore, it is not legal to cash a PD check in Texas until the date written on it. With modern computerized banking, however, checks are often deposited through automatic machines and the computer does not read the date, so the check is accepted and the funds paid over. If the payee deposits the check inside the bank, the teller may notice that it is postdated and refuse to accept it.

Bank Liability

According to the UCC Section 4-403(b), the payer is required to notify his bank in the event that he has issued a PD check, and to provide information such as the name of the payee, the value of the check and the date on which it is due for payment. Without this information, the bank may either reject or "bounce" the check or cash it. If the bank receives notice in time and still cashes the check, it may be liable for loss or damages, including costs if other items are dishonored because of insufficient funds.

Impact on Credit Score

If you write a PD check in Texas and do not notify the bank in time, it is within its rights to cash it. If this happens, unless you have overdraft protection, your bank account will be overdrawn and you may be responsible for additional fees. Unauthorized overdrafts or bounced checks may also count against your credit score.