The bull run meaning is when the stock market is characterized by a sustained rise in share prices. This occurs when investors believe the positive trend will continue for the long term. Such optimism is usually based on strong positive indicators for a country's economy, including high employment levels.

The opposite of a bull market is a bear market, in which share prices decline. This usually happens when investors believe the economy will slow down and unemployment will rise.

Video of the Day

Video of the Day

Consider also: What Do the Numbers on the Stock Exchange Mean?

Origins of Bull Run Definition

The origins of the term are not entirely clear, but bull and bear markets could be named after the way in which each animal attacks. The bull will typically drive its horns up into the air, while a bear will swipe its pawns downward upon its prey. The term "bull" came into usage in the early 18th century when it referred to a speculative purchase of a stock on the expectation that it would rise.

Causes of a Bull Market

When the economy is strong, more people have more money and are willing to spend it. This drives share prices up, because demand is then stronger than supply. However, investor psychology also plays an important part in determining which way the market will go.

Investors try to predict whether stocks will go up or down in value, and they very often follow what others are doing. That way they create a "herd" mentality, which can drive stock prices up or down, even against economic indicators. These factors can lead to a bull run in the stock market.

Consider also: 6 Characteristics of the Stock Market

When a Bull Becomes a Bear

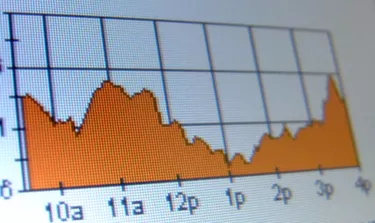

If a stock goes up in value from the previous day, that does not necessarily mean a bull market. For a market to be characterized as bull, the change in stock prices has to occur over a longer period. Another important indicator is the degree of the change. Most definitions say a bull market is characterized by a rise of 15 to 20 percent over at least two months. Similarly, a decline of the same degree over the same period of time is known as bear market.

Taking Advantage of a Bull Market

Investors can take advantage of rising prices by buying early in the trend and then selling when stocks have reached their peak or have come close to reaching it. Of course, knowing exactly when stocks are at the bottom or the peak is impossible, but closely following market reports and other indicators, as well as gut feelings, can help investors make good guesses.

Consider also: How to Become a Millionaire in the Stock Market

Beware of the Bull Trap

When a stock goes up in value, many investors will want to buy it, hoping to sell it later, when it is even more expensive, and make a profit. This sudden surge in demand for stock will occasionally bring a sudden surge in supply, pushing the price down. Holders of recently acquired stock can end up with losses. This is known as a bull trap.