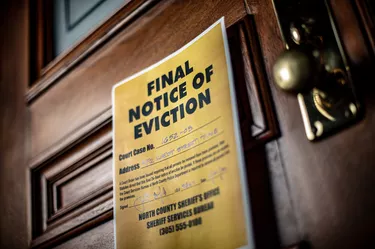

An eviction notice is a formal notice from a landlord to a tenant saying that they must vacate the property within a certain time frame. Eviction notices are typically issued for nonpayment of rent, damage to the property or other rental agreement violations. Once an eviction notice is issued, the renter has a limited time to remedy the situation (like remitting unpaid rent up front or committing to a payment plan, explains the Consumer Financial Protection Bureau), or they will be forcibly removed from the premises by law enforcement.

What Is an Eviction Record?

Video of the Day

An eviction record is a public record that details any instance where a tenant has been evicted from a rental property for violation of the lease agreement. Landlords, employers and others who may want to check an individual's rental history report may be able to check these records. An eviction can stay on your record for up to seven years, per the Consumer Financial Protection Bureau, although some states have laws that limit how long an eviction can be reported.

Video of the Day

In California, for instance, past evictions can only stay on your record for up to three years. In Oregon, an eviction can stay on your record for up to five years. In Massachusetts, an eviction can only be reported for up to four years. Check with your lawyer to see how long an eviction will remain on your record in your state.

Being evicted can significantly impact your ability to rent in the future, as most new landlords will check an applicant's rental history before approving them for a lease at a new apartment. This sort of tenant screening by a property manager is legal, so it's best to avoid eviction if at all possible.

Removing an Eviction From Your Record

Can you get an eviction removed from your record? The short answer is maybe. In some cases, you may be able to have an eviction removed from your record through what's called "expungement." Expungement is a legal process that can remove certain types of records from public view. To get an eviction expunged, you'll need to file a petition with the court and prove that the eviction was wrongful or that you've overcome your past housing problems.

If your eviction case petition is approved, the court will issue an order to have the eviction removed from your record. Once the order is issued, landlords and others who perform background checks will no longer be able to see the eviction on your record.

You may also be able to have an eviction removed from your record by sealing it. Record sealing is different from expungement in that it doesn't actually remove the eviction from your record. Instead, it restricts public access to the record. To get an eviction sealed, you'll need to file a petition with the court and prove that the eviction should be sealed because it's causing you undue hardship. If your petition is approved, the court will issue an order to seal the record. Once the order is issued, landlords and others who perform background checks will still be able to see the eviction on your record, but they'll have to go through extra steps to do so.

Employment and Evictions

In most cases, employers can run a background check before deciding to hire you. This check will include an eviction record if one exists. However, there are several states where employers cannot consider an eviction when making hiring decisions. These states are California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Massachusetts, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island and Vermont.

Eviction Records and Credit Scores

While an eviction itself will not directly impact your credit score, it can lead to other financial problems that could have a negative effect on your credit history and be documented by the major credit reporting agencies.

If you are evicted and owe rent payments to your landlord, this issue could be turned over to a collection agency. Collection accounts can stay on your credit report for up to seven years and can have a significant negative impact on your credit score. This sort of financial situation may make it more difficult to obtain funds from lenders or credit cards.

If you are served with an eviction notice, it is important to understand your rights and options under the law. An attorney can help you navigate the eviction process and protect your rights as a tenant. They can also offer legal advice for dealing with credit bureaus, like Experian and Transunion, and what to expect from credit checks as well as consideration of a potential eviction lawsuit or civil judgment.