A pretax deduction is an employer-sponsored benefit that meets Internal Revenue Service requirements. The benefit provides tax exemptions that lower the employee's taxable wages. Pretax deductions are often not subject to Social Security and Medicare taxes, which are governed by the Federal Insurance Contributions Act, or FICA.

Deductions Exempt From FICA

Video of the Day

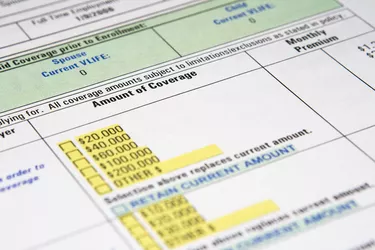

Qualified benefits offered under a cafeteria or Section 125 plan are exempt from FICA. This includes contributions made toward a medical, dental, vision and accident insurance plan and toward a flexible spending account, such as dependent care assistance and medical care reimbursements. Payments toward health savings accounts and group-term life insurance of $50,000 or less, plus qualified transportation expenses and disability insurance, are exempt from FICA.

Video of the Day

Pretax Versus After-Tax Deductions

If the benefit is exempt from FICA taxes, the employer subtracts it from the employee's wages before withholding Social Security and Medicare taxes, giving the employee a tax break. If the benefit does not meet the respective Internal Revenue Code but the employer offers it anyway, it should be deducted on a post- or after-tax basis. In this case, FICA wages are not reduced, because the employer withholds Social Security and Medicare taxes from the benefit.

Benefits That Do not Lower FICA Earnings

Some benefits are excluded from federal income tax but not FICA taxes. For example, employers do not withhold federal income tax from employees' pretax 401(k) contributions, but Social Security and Medicare withholding apply. Premiums for adoption assistance and group-term life insurance on coverage over $50,000 are not subject to federal income tax, but FICA taxes are taken out. FICA taxes must be deducted from all benefits offered on an after-tax basis, including post-tax retirement plans such as a Roth 401(k).

Wages Excluded From FICA

An employer must establish an IRS-qualified accountable plan to offer nontaxable business expense reimbursements, which are exempt from FICA taxes. A primary requirement of the plan is that the reimbursement must be a necessary and ordinary business expense. Reimbursements for uniforms, meals, lodging, travel, moving or relocation, tools, vehicle usage, cell phone and home office expenses are not subject to FICA taxes if covered under an accountable plan.

FICA Wages on a W-2

Boxes 3 and 5 of an employee's W-2, respectively, show her reduced Social Security and Medicare wages. Because those are taxable amounts, they do not reflect pretax deductions that are exempt from FICA taxes, only the reduced wages. Those figures may differ from the amount in Box 1, which depict wages subject to federal income tax. This can happen if the employee has pretax deductions that are exempt from federal income tax but not exempt from FICA taxes.