Interpolation is a mathematical process to estimate the value of a dependent variable based on the values of known surrounding dependent variables, where the dependent variable is a function of an independent variable. It's used to determine interest rates for periods of time that are not published or otherwise made available. In this case, the interest rate is the dependent variable, and the length of time is the independent variable. To interpolate an interest rate, you'll need the interest rate of a shorter period of time and a longer period of time.

Step 1

Subtract the interest rate of a time period shorter than the time period of the desired interest rate from the interest rate of a time period longer than the time period of the desired interest rate. For example, if you are interpolating a 45-day interest rate, and the 30-day interest rate is 4.2242 percent and the 60-day interest rate is 4.4855 percent, the difference between the two known interest rates is 0.2613 percent.

Video of the Day

Step 2

Divide the result from Step 1 by the difference between the lengths of the two time periods. For example, the difference between the 60-day time period and the 30-day time period is 30 days. Divide 0.2613 percent by 30 days and the result is 0.00871 percent.

Step 3

Multiply the result from Step 2 by the difference between the length of time for the desired interest rate and the length of time for the interest rate with shortest length of time. For example, the desired interest rate is 45 days away, and the shortest known interest rate is the 30-day rate. The difference between 45 days and 30 days is 15 days. 15 multiplied by 0.00871 percent equals 0.13065 percent.

Step 4

Add the result from Step 3 to the interest rate for the shortest known time period. For example, the interest rate from the 30-day time period is 4.2242 percent. The sum of 4.2242 percent and 0.13065 percent is 4.35485 percent. This is the interpolation estimate for the 45-day interest rate.

Tip

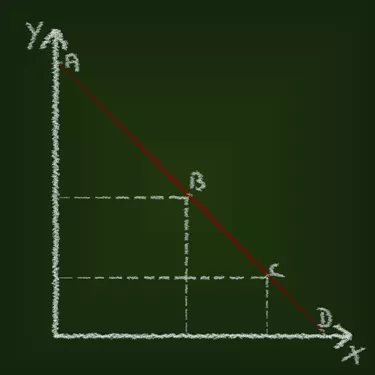

To make sure that you are correctly following the equation, it may help to draw a graph. The graph should have one axis representing interest rates, with the other axis representing the length of time. Draw a straight line through the two points representing the known interest rates. If the interest rate you interpolate falls outside this line, you will know that you made an error along the way.

Warning

The linear interpolation is an estimate for the interest rate of a specific time period, and it assumes that the interest rate changes on a straight line basis between each day. In reality, interest rates may follow a "yield curve" instead of a straight line. The estimate will be more accurate the shorter the period of time between the known interest rates you are interpolating from.

Things You'll Need

Calculator

Pencil

Paper

Video of the Day