Retirement savings plans such as 401k accounts offer a tax-advantaged way to save money for retirement. Unfortunately, that beneficial tax treatment comes with significant rules and regulations. The IRS sets limits on who can contribute to a 401k as well as how much can be contributed. These limitations generally prevent the transfer of a 401k from one person to another.

401k Basics

Video of the Day

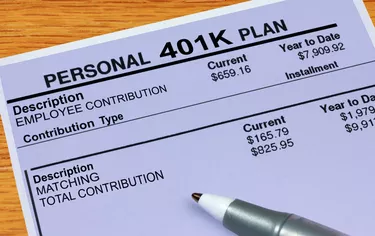

A 401k is a salary-deferral plan that allows the account holder to contribute money for retirement without paying taxes on the contribution. The money inside the 401k grows tax-deferred until it is withdrawn, at which time normal income taxes are due on all funds withdrawn. 401k accounts are individual accounts and cannot be held jointly.

Video of the Day

401k Rollover Basics

A 401k rollover allows an account owner to move funds inside of a 401k account to another qualified account without paying taxes or penalties. Qualified accounts are typically traditional IRAs and other 401k plans. To qualify as a tax-free rollover, funds taken from the 401k must be redeposited into the new retirement account within 60 days. 401k rollovers are reported to the IRS on Form 1099-R.

401k Rollover Rules

401k rollovers can occur in two ways. The first way never allows the funds to come into possession of the account holder. Funds are transferred electronically to the new account, or a check is issued made out to the new account. Either way, such transfers can only be made to an account with the same taxpayer ID as the original account. The second way distributes the funds directly to the account holder. In this case, the plan administrator is required to withhold 20 percent of the distribution for taxes. However, for the rollover to be tax-free, the full amount must still be deposited into a new account with the same taxpayer ID within 60 days.

Transferring 401k Funds to a Spouse

Because all rollovers must occur between accounts with the same owner and taxpayer ID numbers, there is no way to directly roll over funds to a spouse's 401k. Even though an unlimited amount of money may be transferred between spouses tax-free, contributions to 401k plans may only be made via salary deferral. The only way to get money from one spouse's 401k to another is to withdraw funds from one 401k plan while increasing the withholding going to the other spouse's 401k plan.