Sending a card with a check in it to a child is common. You might even want to give a check to the teenager who cuts your grass. But it's a little tricky writing checks to a minor child. For example, how do you know if a financial institution will accept a check with a 5 year old as the payee?

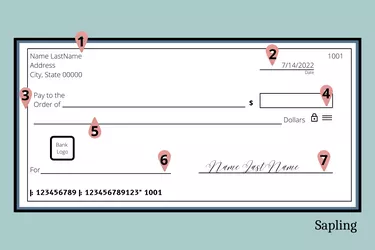

How to Fill Out Check

Video of the Day

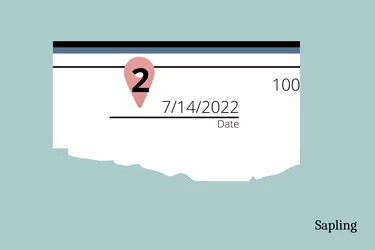

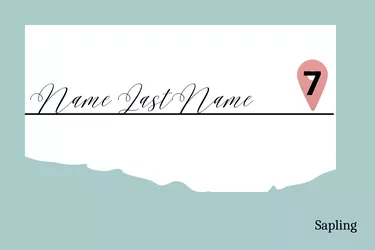

Make sure you complete the check when writing a check to a minor child. Start with the date, which is in the upper right corner under the check number. It's also located on the check diagram as number two.

Video of the Day

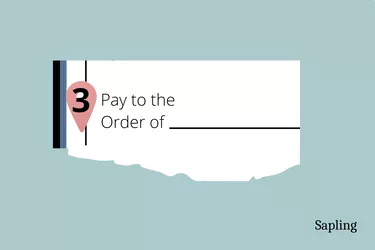

Then proceed to the area of the payee. This is the name of the person you'll be making the check out to. It's noted on the check as "Pay to the order of." This is located at number three on the check diagram.

Add Minor Child as Payee

If this is the first time adding a child's name to a check, it might be a little confusing. After all, how do children deposit checks when they may not have a checking account? A young child also doesn't have a driver's license for identification, complicating it even more.

Determine if the child is capable of endorsing the check with the parent. The minor child may not know how to write. In which case, a gift card might work better.

But if you're determined to send the child a check, write the name of the person, then "or" and the parent's name. For this to work, the parent needs to have a bank account at a financial institution.

Once you have filled out the child's name followed by "or" and parent's name, the parent can take the check to the financial institution, and the bank teller will cash it. Or, if the parent wants to deposit it without cashing it, they can make a mobile deposit using their credit union or bank mobile app.

Add the Dollar Amount

Once you've written the name of the person in the "Pay to the order of" line, you'll need to add the numerical dollar amount in the box adjacent to the line. This is number four on the check diagram.

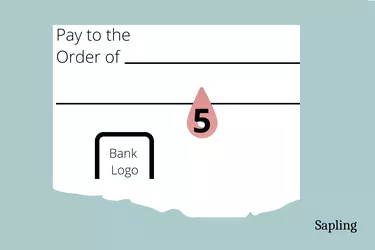

On number five of the check diagram, you'll see a line. This is where you write out the dollar amount, including cents.

Memo Line and Signature Line

Number six on the check diagram is the memo line. It is labeled as "for." Write a reminder of the purpose of the check. For example, write "birthday" on that line if it's a birthday gift.

Finally, you must sign the check the signature line. This is in the bottom right corner of the check and number seven in the diagram.

How to Endorse a Check for a Child

Endorsing a check is necessary when cashing a check. If a check is made out solely to a minor without a parent's name on it, a parent still must sign for the child. In that case, on the back of the check, write the child's name. Then you'll need to make a dash and write the word minor. After that, the parent or guardian must write the parent's name below the child's name.

Cash Check for a Minor Child

A minor is not legally able to cash checks or deposit checks. A parent must be part of the process. Even if a minor has a custodial bank account, they still must have a parent cash the check. Some financial institutions allow a minor to have a debit card to teach the child personal finance and budgeting.

Although a minor child can have a debit card, they can't have a checkbook.

Minor Child Custodian Bank Account

A minor can only have a bank account or account with a credit union if they have a parent or guardian on the account as well. In other words, the child must have a parent's approval. This is the case regardless of whether it's a savings account or a checking account.

When opening a minor child's bank account, the parent must have identification. If the child doesn't have other forms of identification, their Social Security card will do.

Tip

If you write a check to a child who cannot endorse the check, a parent will have to endorse the check with the child’s name, write “minor by” and then sign the parent’s name underneath.