The term "deferral" when used in conjunction with 401K plans refers to the deferral of wages and income tax. Employees can elect to receive part of their paycheck as deferred compensation which means they neither take immediate possession of it nor pay taxes on it when the employer invests it into the 401K deferred compensation plan.

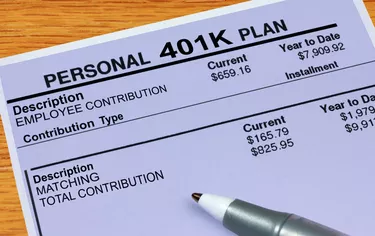

Plan Contributions

Video of the Day

As of 2011, people working for companies that offer 401K plans can choose to have up to $16,500 of their annual salary invested in the plan as deferred compensation. Employees over the age of 50 can have up $22,000 of their annual salary invested in a 401K plan. Many companies choose to match employee 401K contributions up to 6 percent of the employee's annual salary. The company's matching contributions are also paid as deferred compensation.

Video of the Day

Deferred Taxes

The money held inside a 401K account enjoys tax-sheltered status until the plan participant makes withdrawals. When funds are withdrawn the participant must pay ordinary income tax on the principal and earnings withdrawn from the account. The Internal Revenue Service imposes a 10 percent penalty tax on any withdrawals made from 401K accounts prior to the plan participant reaching age 59½. In addition, participants of all ages must pay the penalty tax if they access funds and have held the account for less than five years.

Benefit Of Deferral

People with 401K plans benefit from having a portion of the salary paid into the account because typically they are in a lower tax bracket when they retire than when they are working. Therefore for most people, the income taxes assessed on principal contributions are less if taxed after they retire than the taxes would have been if taxed while they were working. Additionally, the earnings grow tax deferred, which means the participant earns interest on interest as earnings compound. Earnings from non-tax-deferred accounts are taxed on an annual basis, which means earnings cannot compound.

Misconceptions

Some 401K plans are not funded with tax-deferred compensation. In these plans investors contribute a portion of their after-tax earnings and employees make matching after-tax contributions. The funds do grow tax deferred, which means you earn more than you would if you invested in a non-tax-deferred account. However, when you withdraw money from the account you must pay taxes on the earnings. You do not have to pay any taxes on principal withdrawals.