IRA stands for individual retirement account. Tax-deferred IRAs, including traditional IRAs, SEP IRAs and SIMPLE IRAs, allow qualified withdrawals to be taken any time after age 59 1/2. However, Roth IRAs also require that the account be open for at least five tax years before qualified withdrawals can be taken. Withdrawals have a two-part process: requesting the withdrawal from your financial institution and reporting the withdrawal on your income tax returns. Even if you take a withdrawal from a Roth IRA and owe no taxes, you must still report the distribution.

Step 1

Contact your financial institution or check your financial records to determine the age of your Roth IRA in tax years. The account must be at least five tax years old for the withdrawal to be a qualified withdrawal. If the Roth IRA is not at least five tax years old, you may owe income taxes and penalties if your withdrawal includes earnings. This restriction does not apply to tax-deferred IRAs.

Video of the Day

Step 2

Request a distribution from your financial institution by completing an IRA distribution request form. These forms are slightly different for each financial institution.

Step 3

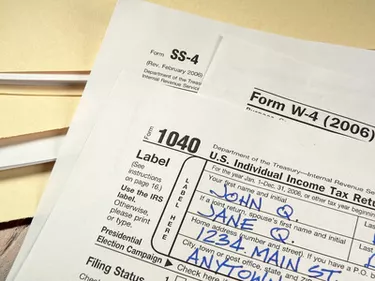

File your income taxes using form 1040 or 1040A and report the amount of the distribution. You will receive a form 1099-R from your financial institution that will report how much of your distribution, if any, is taxable.

Step 4

Complete form 8606, part III, if your distribution is from a Roth IRA that has not been open for at least five tax years. This form will determine whether your withdrawal contains contributions, earnings or both. If your withdrawal only contains earnings, the withdrawal is tax-free and penalty-free. If the withdrawal contains earnings, you must file form 5329 to calculate the early withdrawal penalty you will owe.

Things You'll Need

Form 1040 or 1040A

Form 5329

Form 8606

Video of the Day