Volume-weighted average prices (VWAP) are the final prices for stocks and other securities that are published in newspapers each day. VWAP calculations help prevent end-of-day price manipulations and wild last-minute price fluctuations that can distort security prices and mislead investors. It's the average price of a security during a fixed time period before the close of trading. The time period ends with the close of trading or the last time a security is traded during the trading day. The method of calculating a VWAP depends on the trading rules of the market it is being used in. Here you will learn how to calculate the VWAP for any single security.

Step 1

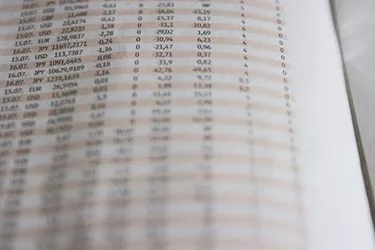

Collect the stream of price transactions for a security during a single trading day and enter them into your spreadsheet program on your computer. You must have every buy and sell price during the trading day for the security in question. There could be hundreds or even thousands of transactions for very heavily traded securities.

Video of the Day

Step 2

Collect the quantity or number of shares in each trade up to the end of the trading day. Having every trading price matched to the number of shares traded will give you the data you need to do the VWAP calculation.

Step 3

Multiply the price of each trade by the number of shares and add the results. If 10 shares of a security sell for $100 each in one trade and 15 shares sell for $100 in another trade, you would first multiply 10 x 100 = 1,000 for the first trade and then 15 x 100 = 1,500 in the second trade. When you complete the list of trades, add the products of all the trades: 1,000 + 1,500 = 2,500. Now you can complete the final step in the VWAP calculation.

Step 4

Add the number of shares that traded. In Step 3, that would be 10 + 15 = 25 shares. Divide the sum of the products calculated in Step 3 by the sum of the total shares that traded. So the VWAP would be: 2,500/25 = 100.

Tip

Calculating the VWAP is not a substitute for developing a trading strategy that will be profitable.

Things You'll Need

Computer or calculator

Spreadsheet software program

Stream of security prices

Quantities of each transaction

Video of the Day