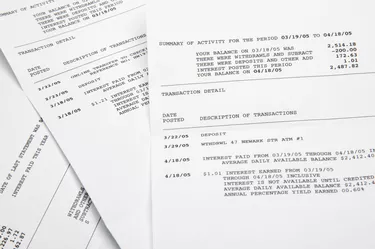

There are three main financial statements investors analyze. They are the balance sheet, income statement and the cash flow statement. The balance sheet is a snapshot in time. It shows all the assets owned and liabilities owed for a company. It also shows the amount of equity or ownership that is paid for by investors. The income statement looks at the entire year. It starts with revenues and then deducts expenses for net income. The cash flow statement shows where the cash is really coming by breaking down cash flow into cash from operations, investing and financing. There are advantages and disadvantages to analyzing financial statements for investment decisions.

Full Disclosure

Video of the Day

Full disclosure is one of the main advantages of, and one of the main purposes for, financial statements. The Securities and Exchange Commission made the 10K report a requirement for all public companies. This 10K includes full disclosure of all financial statements as well as notes explaining all assumptions contained with the notes.

Video of the Day

Intrinsic Value vs. Market Value

While financial statements are good for the data needed to conduct a thorough ratio analysis, they are based on the accrual system of accounting, which is not market based. This is both an advantage and a disadvantage. It's good to have a basis for comparing book value to market value. Above all it helps to pinpoint bargains in the market. However, value discrepancies can also work to the disadvantage of financial statement analysis. It can make it difficult to know the real value of assets, which translates into unreliable ratios.

Transparency

Unfortunately, since financial statements are easy for everyone to understand, it's also very easy for people to hide information. For instance, an analyst has to look at the cash flow statement to know if cash flow is coming from operations or additional financing activities. There are also certain conventions like depreciation and inventory accounting that can increase or decrease net income, depending on the convention used.