Reconciling a bank statement is not difficult. There are a few items that will be required. Once the receipts are rounded up, compare them to the statement from the bank, make adjustments and it is done. The trick to a successful bank reconciliation experience is organization and having the proper tools.

Step 1

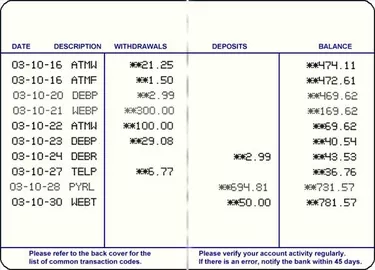

Assemble all of the receipts for the month. This includes deposit records, ATM receipts, cash withdrawals, and payments by debit or credit cards that are linked to the account. Remember to include all automatic recurring payments and payments made through online banking services. The account register and the current bank statement are required. Add to this a pen or pencil and a calculator.

Video of the Day

Step 2

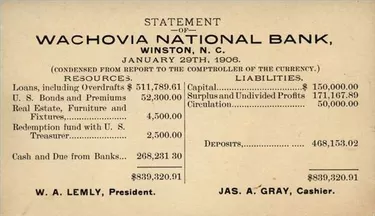

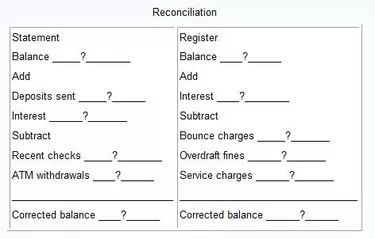

Compare the entries in the account register to the bank statement. Make note of any discrepancies. Deposits and checks that are written close to the statement date may not appear. Make a list of these items. Compare the receipts with the account register and the bank statement. Make a list of any transaction that has no receipt or that cannot be accounted for. Once every transaction in the account register and on the bank statement is accounted for, note the beginning and ending balances. These will be found on the bank statement.

Step 3

Starting with the ending balance on the bank statement, add in all the deposits that were made but did not appear on the statement. Take a subtotal and note this number. From the subtotal, subtract all checks, debit card, credit card, automatic payments and other withdrawals that are accounted for in the register but are not listed on the bank statement. Compare the results with the balance in the account register. These numbers should be equal. If they are not, there is a problem. Repeat steps one and two making sure that numbers were not transposed in error. This is usually the cause of a discrepancy.

Report any suspicious transactions to the bank immediately. This protects your financial interests and identity. Most often unidentified transactions are oversights and forgotten purchases.

Step 4

Spreadsheets like Excel can be used to help reduce errors. To set up a spreadsheet, enter the ending balance from the statement into a cell. List all deposits not listed on the bank statement in separate cells. Create a formula to add all the numbers together. List in separate cells all withdrawals from the account that are not reflected on the bank statement. Create a formula to subtract these items from the first subtotal. This amount should equal the balance shown in the account register.

Tip

Unable to reconcile the transactions? Call the bank. They are willing to help. Report any undocumented transactions or errors to the bank immediately.

Things You'll Need

Current bank statement

Account register

Receipts

Calculator

Pen or pencil

Lined paper

Spreadsheet software (optional)

Video of the Day