Every tax season, you might get several tax forms from different sources reporting income you had earned. You won't find interest income on W-2 forms since those are what employers send to employees to report earnings and taxes from jobs. Instead, financial institutions you do business with may send a Form 1099-INT for reportable interest income earned on accounts and other investments. This form is important not only for showing interest amounts earned but also for identifying what may be taxable.

Consider also: Tax Return Preparation: Tax Services, Tax Help & More

Video of the Day

Video of the Day

What Is My Interest Income?

Per the IRS rules, interest income refers to money someone pays you for letting them borrow or otherwise use money from you. You're likely very familiar with the interest your bank or credit union pays on the money you deposit and keep in a savings account, certificate of deposit or similar banking product. However, interest income can come from other sources such as corporate or government bonds, dividends, promissory notes as well as certain late insurance claim payments.

Looking at Interest Income Taxation

Many interest income types will be taxable at your regular federal income tax rate, but you won't pay Medicare and Social Security taxes on it. This would include earnings from sources like bank accounts, savings bonds, U.S. Treasury securities and businesses.

On the other hand, you'll need to report interest income from other sources but not pay federal taxes on the amount. Examples include interest on municipal bonds plus Series I and EE savings bonds used to pay for education costs (when certain criteria are met).

Note that you might find that the taxability of your interest income will vary at the federal level than it does at the local and state levels. Therefore, it helps to check with a tax professional.

Using Your Form 1099-INT

By the end of January each year, the entity paying you the interest income should send a Form 1099-INT unless the interest earned was below $10. While this form has many boxes, box 1 is crucial since that is where you'll find interest income. You'll find any tax-exempt interest listed in box 8, so you might need to deduct that from the total interest income to determine what is taxable and what is not. Other boxes report items such as early withdrawal penalties, investment expenses, taxes withheld and any premiums or discounts.

While Form 1099-INT makes it easier to find and report your interest income, note that not receiving the form doesn't mean you have no reportable interest income or owe no taxes. In that case, you'll need to check with your financial institution to determine the interest received that year so you can include this on your tax return. You'll also need to consider whether it's taxable or tax-exempt per the IRS rules.

For example, you might log in to your online savings account and find a report showing interest earned by the year. The information might also be reported on your bank statements, or you could call a banking representative to get the interest amount paid directly.

Consider also: Who Must File Income Taxes?

Reporting Interest Income

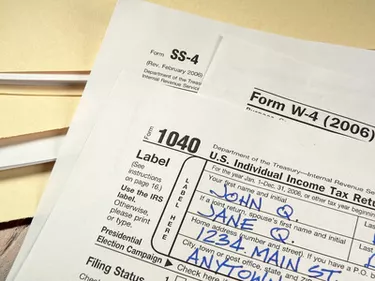

If you're wondering where to put interest income on 1040 forms, take a look at the lower half of the first page where you report various forms of income. You'll see that you should report your tax-exempt interest income on line 2a and your taxable interest income on line 2b. The taxable amount from line 2b gets carried over to the right so it can be included in your total taxable income.

However, you might need to attach another form to report interest income. You'll fill out Schedule B under certain circumstances such as when your taxable interest exceeds $1,500 or you earned interest on certain investments such as bonds. The first part of this tax form is where you provide information about the payer and amounts for interest income.

Consider also: Form 1040: What You Need to Know