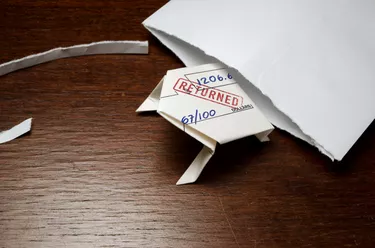

There are few things more unnerving than learning that your IRS check bounced. While it is never good to bounce a check, the IRS has a clear and straightforward dishonored check policy.

In most cases, you will need to pay a penalty fee and will be charged interest on that penalty. There are, however, processes in place for removing or reducing the penalty in cases where you made your payment in good faith and something has gone wrong, such as a bank error or someone draining your account of funds.

Video of the Day

Video of the Day

Consider also: Tax Return Preparation: Tax Services, Tax Help & More

IRS Dishonored Check Policies

Once the IRS learns that your check has been returned for nonsufficient funds (NSF), it will send you a letter notifying you of the situation, although you are probably already aware of what has happened because you have received notification from your bank.

Letter 608C, Dishonored Check Penalty Explained, will arrive via postal mail and describes the IRS's policy for handling situations like this. It details the financial penalties as well as your right to challenge the penalties or ask for some relief.

Fees and Interest

As is true with most businesses, creditors and payees, there is a fee for bouncing a check made out to the IRS:

- For payment amounts less than $1,250, the penalty is the full payment amount or $25, whichever is less.

- For payments over $1,250, the penalty is 2 percent of the payment amount.

According to IRS.gov, the IRS charges interest on these fees, which will increase the amount you owe. Keep in mind that these fees and interest charged by the IRS are in addition to whatever fees your bank charges you for bouncing a check.

IRS policy does not allow it to charge fees on a dishonored check if you put a stop payment order on it. If you are charged a fee, you should write to the IRS providing documentation of the stop payment request.

Reducing, Removing and Disputing Penalties

The IRS process for reducing or waiving penalties is called abatement. Wait until you receive a letter from the IRS notifying you of the dishonored check. It will explain what you need to do to request abatement.

Typically, you will need to show that you acted in good faith when you sent your check and had reason to believe that the check would clear. Make copies of documentation that support your case and send those documents along with a letter of explanation to the address provided by the IRS. If you do not receive a letter within a reasonable amount of time after the check bounces, call the IRS and ask for assistance.

If you are unable to resolve your issue with the IRS by mail or over the phone, you can contact the Taxpayer Advocate Service (TAS), which is an independent office within the IRS that works to ensure that all taxpayers are treated fairly. The TAS may be able to provide assistance.

Consider Also: Form 1040: What You Need to Know

Avoiding Dishonored Checks

If you are concerned about dishonored checks, there are several ways of making payments to the IRS that reduce or eliminate those risks. First, the IRS does accept electronic payments in the form of bank wires, credit or debit cards or electronic drafts on your bank account. All of these can be set up on the IRS website.

Another option is to make your payment using a money order or cashier's check. Since you pay the bank or issuer cash for the money order/cashier's check, there is no risk of your payment being dishonored.

A third option is to pay with cash. While this can be cumbersome, the IRS has partnered with third-party services that allow you to make cash payments to the IRS at the register in many retail stores, including 7-Eleven and CVS Pharmacy.