A judgment is a final decision made by a court of law in a lawsuit or criminal proceeding. It is usually recorded with a clerk of court in public records. Credit bureaus report judgment information in credit reports that relate to debt collection. A creditor who has been awarded a judgment can report it to the credit bureaus so it appears on the debtor's credit report.

Step 1

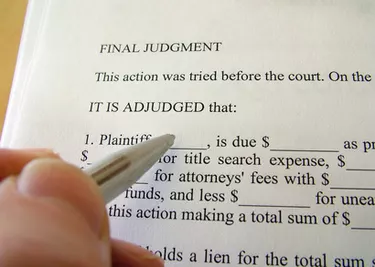

Collect the information regarding the judgment. Since judgments are recorded in public records, obtain a copy of the judgment. It will have a control file number (CFN) and an official records book and page number for identification. Some county clerk of court offices scan copies of court documents and upload them onto the county clerk's website. This is another way you may be able to obtain a copy of the judgment.

Video of the Day

Step 2

Contact a credit bureau. The three major credit bureaus are Experian, Equifax and TransUnion. Call them and let them know you would like to report a judgment on a consumer or business. They may ask you to mail the details regarding the judgment to them.

Step 3

Receive confirmation the judgment was included in the credit report. You can ask the credit bureaus to provide you with written confirmation the judgment was recorded in the consumer's or business's credit file or report. It may take a month or longer for the information to be recorded. A consumer or business can try to dispute the information you reported. Make sure you have a copy of the judgment so the credit bureau has proof the information is accurate.

Tip

A judgment can remain on a consumer's credit report for up to seven years.

Video of the Day