Police officers may have to pay for job-related expenses out of their own pockets due to lack of department funding or the denial of requisitions. The Internal Revenue Service (IRS) allows U.S. peace officers to deduct on their federal tax return most expenses related to the proper performance of their job if such expenses exceed 2 percent of their adjusted gross income.

Memberships

Video of the Day

Police officers can write off on their taxes any dues paid to unions or membership organizations but they cannot deduct admission or application fees required to join an organization, according to CYA Taxes. They can also take a deduction for all professional journal and trade magazine subscriptions related to their jobs. Peace officers can write off out-of-pocket medical, dental and disability and insurance premiums.

Video of the Day

Supplies

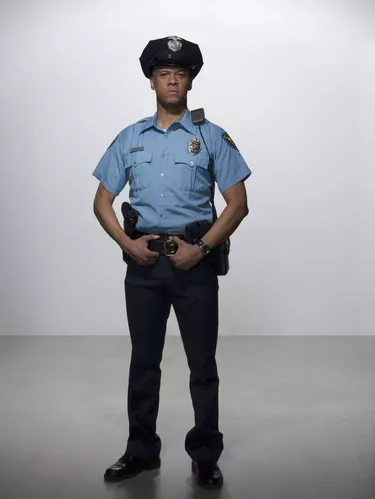

A police officer can take a full tax deduction for any necessary supplies purchased for use in his line of work, such as a passport, weapon or ammunition, if his department does not reimburse him for his expenses. He can also take a deduction for work clothes and uniforms if the department requires these purchases and he does not wear the clothing outside his line of work.

Education

Police officers who take training classes or choose to obtain higher education in order to further their careers can write off education expenses on their annual federal tax returns. The training or education must be directly related to the job or the IRS will not allow a deduction. Officers can write off up to $4,000 in tuition and fees or they can itemize their deductions to claim expenses in excess of 2 percent of their adjusted gross income as of 2011, according to the IRS.

Travel

Law enforcement officers can deduct 51 cents per mile driven or actual car operating expenses if they use their own vehicle to get to work or perform their job outside of their metropolitan area on a temporary basis. Officers who travel out of town for work can deduct 50 percent of reasonable lodging, meal and public transportation expenses for which their department does not compensate them, according to CYA Taxes.

Communication

Most peace officers carry a cell phone strictly for use in work, as they are on-call in instances of emergencies. They can take a deduction for cell phone or second land line bills. If law enforcement agents use a secondary phone line for both work and pleasure, they can only deduct the percentage of the phone bill used for work.